Create A Small Steps Savings Plan

Creating a small steps savings plan can be an effective way to achieve your financial goals without feeling overwhelmed or discouraged. Here are some steps you can take to create a savings plan that works for you:

1. Define your financial goals

The first step in creating a savings plan is to define your financial goals. This could be anything from saving for a down payment on a house, to building an emergency fund, to investing for retirement. Once you’ve identified your goals, determine how much you need to save and by when.

Here are some tips on how to use The Spending Diary to meet your financial goals, align your spending with your values; and help change your money mindset and money story.

2. Break down your financial goals into smaller, achievable goals

Next, break down your financial goals into smaller, more manageable goals that you can work towards over time. For example, if your goal is to save $10,000 for a trip to Europe, you might aim to save $416.67 per month. This can be less overwhelming than focusing on meeting your $10,000 target amount.

3. Create a Budget

Creating a budget is a crucial step in any savings plan. Calculate your monthly income and expenses and identify areas where you can cut back to free up more money for savings. This might involve reducing spending, negotiating bills, or finding ways to increase your income.

4. Automate Your Savings

One of the most effective ways to save money is to include it as part of your budget. Pay yourself first. Set up automatic transfers from your checking account to a savings account. This will ensure that you’re consistently setting money aside towards your financial goals, even if you don’t have the time to do so manually.

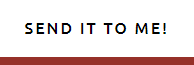

5. Prioritize debt repayment

If you have outstanding debts, it’s important to create a repayment plan – prioritizing repayment. This might involve focusing on higher-interest debt first and/or consolidating multiple debts into a single payment to make the payment more manageable. By reducing your debt burden, you’ll be more motivated to save and you should have more money available for savings.

Stay on track

Share your financial goals with a friend and/or family member that you trust. This may provide some accountability and support. In addition, sharing your money goals can help you stay motivated and on track with your savings plan.

Summary

In conclusion, creating a small steps savings plan can be an effective way to achieve your financial goals. By defining your goals, breaking them down into smaller, achievable steps, creating a budget, automating your savings, prioritizing debt repayment, and seeking accountability and support, you can build momentum and achieve success over time. Remember, even small steps can lead to big results.

Check out some of my small steps savings plans. Start from where you are now. But, it’s important to get started!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

The Power of the Debt Snowball Method

Unlocking Financial Freedom: The Power of the Debt Snowball Method Facing Financial Challenges In today's fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle...

The Prosperity Game: Transform Your Money Mindset

Transforming Your Money Mindset Transforming your money mindset starts with small changes. In a world where money is often associated with stress and scarcity, cultivating a healthy money mindset can be a game-changer. The Prosperity Game is a powerful tool that...

Mindful Money Management

Mindful Money Management A concept that involves being conscious, intentional, and aware of how we handle our finances. It goes beyond traditional budgeting methods and tracking expenses; it encompasses a holistic approach to money that considers our values, goals,...

A Budget Is A Powerful Tool

A Budget Is A Powerfult Tool Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money. Unlocking Financial Freedom: Small Steps Budget Kit Are you ready to embark on a journey towards financial...

Track Your Spending

Track Your Spending Habits Money is and will always be an essential part of our life. Sometimes it may feel overwhelming to manage your money; but one way you can change your money mindset is by tracking your spending habits. Keep a Spending Diary Keeping a spending...

Selling On ETSY – How I Eventually Found Success Selling Digital Products

My Entrepreneurial Journey – How I Eventually Found Success Selling On ETSY My Entrepreneurial Journey hasn’t been a straight line but I’ve finally found success selling on ETSY MY STORY Using ETSY,...

4Q Preparation – Tips for ETSY sellers

4Q Preparation - tips for ETSY Sellers The last 3 months of the year can be very busy. To keep your digital product business on track, you should take time to organize your digital files. Getting organized and creating a process In today's video, I've...

Building business credit for startups

Let's talk business credit for startups Today I'm joined by Financial Literacy Advocate Valaise Smith. Valaise specializes in educating small business owners on the ABC’s of finances: Accounting | Budgeting|Credit. The "C" of ABC Building business credit for...

Let’s Talk Mindset – Entrepreneurial Journey

Let's Talk Mindset - Entrepreneurial Journey As we approach one of the busiest quarters of the year, I want to discuss how to change your mindset to be successful. A little motivation Entrepreneur Motivation - Change Your Mindset, Change Your Business. A simple...

What’s New In Canva

What's New In Canva I've created a brief tutorial for Canva's new editing feature. This new feature will allow you to import and edit PDF documents. So, if you create printables or printable planners, this new feature may enhance your design process. I know it has...